However, rather than putting accounting professionals at risk, experts say automation is transforming the industry in positive ways and creating greater demand for candidates with analytical skills to provide deeper business insights.

The impact of automation

Analysis from Accenture predicts robotics will automate or eliminate up to 40% of transactional accounting work by 2020. KPMG Australia recently partnered with IBM Australia to use the technology giant’s Watson supercomputer for large company audits and PwC has also recently implemented a robo-auditor, called RON, on a recent client project.

RON analyses millions of transactions, relationships and patterns in moments, even interpreting the results, before flagging interesting findings to the team to explore,” explains Sue Horlin, Human Capital Leader at PwC Australia. “In effect, technological innovations are freeing up our skilled workforce to spend their time on higher-risk aspects of the audit and provide more insight and analysis than ever before.”

PwC Australia employs more than 7,000 people and Horlin says automation is creating more time to look at the bigger commercial picture. “Automation of data processing means we now analyse more than 100 billion lines of client data each year, allowing our teams to spend more of their effort on interpreting data and providing deeper insights to clients, rather than performing manual testing.”

Horlin adds that an increase in technology is also creating a greater need to secure and review the IT systems that manage financial data. “The growth of risk assurance is testament to the opportunity in the market for IT controls and digital trust, which has seen us hire more people with IT and data analytic skills,” she says. “For example, we now have a drone team in assurance who recently used the technology to do a stock take on a vast and very remote cattle station.”

Trends across the industry

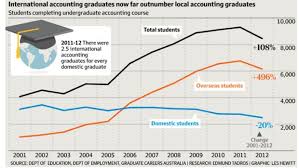

The latest SEEK data shows that job ads grew across a range of roles in the accounting industry in May compared to the same time last year. Job ads for compliance and risk roles, for example, were up by 72% year-on-year. “There is a strong appetite for these roles in the market as they provide an extra means of mitigating risk,” says Rachel Morton, Principal Consultant with recruitment firm Marshall McAdam.

Mark Hetherington, Manager – Finance Commerce at Robert Walters, adds that risk and compliance is a growing focus for businesses. “The increasing level of scrutiny around governance and controls within business, as well as new legislation coming in to play, driven the demand for these roles,” he says.

Job ads for payroll grew by 10% year-on-year while systems accounting and IT audit grew by 67%. Meanwhile, job ads for financial managers and controllers grew by 17%. “This is a reflection of a confident job market and an increase in hiring trends generally,” says Hetherington. “Historically, this has been a hard level for candidates to move in and out of with a limited amount of options, but with an increasingly confident market there are now more opportunities at these senior levels.”

Some areas of the accounting industry experienced a year-on-year decline in May. Insolvency and corporate recovery was down by 10% and bookkeeping and small practice accounting declined by 16%. Hetherington notes that this may be due to technological advancements in finance. “New user-friendly cloud-based accounting software is making it easier for smaller business to trade, whereas traditionally they would require a bookkeeper,” he says.

Attracting top talent

When it comes to attracting the best accounting candidates, Hetherington says employers require a smooth recruitment process. “It can reflect on a business in negative ways if the recruitment process or feedback is heavily delayed,” he says. “Potential employees also want know that your business is a good place to work, so highlight your culture and promote work-life balance.”

Morton suggests that employers focus on the skills required for the role rather than specific industry experience. “Be open minded and look skills of an individual rather than a sector,” she says.

Horlin explains that PwC aims to attract candidates from a wide talent pool.“To help us attract the best talent, we hire a mix of undergraduates, graduates and post graduates across all degree disciplines, experienced hires, and people without formal qualifications,” she says.

Across our business today, our people are predictors, writers of algorithms, critical thinkers, entrepreneurs, business builders, communicators, scientists and change makers,” adds Horlin. “Some have degrees in mathematics, sciences, engineering, technology, marketing, business and finance related fields, and others are highly skilled people with no degree at all. The common threads for all the tasks we perform are relationship skills, communication skills, global acumen, agility and being open to change.”

With technology taking on more transactional accounting functions, competition for talent with analytical skills and strong business acumen may soon get even stronger.